Can Automist help reduce my home insurance premium?

Possibly. While insurance discounts or “policy credits” are determined on a case-by-case basis, Automist has already been used successfully to secure coverage and lower premiums for high-value homes — especially in wildfire-prone areas and PPC 10 risk classifications where traditional coverage is increasingly difficult to obtain.

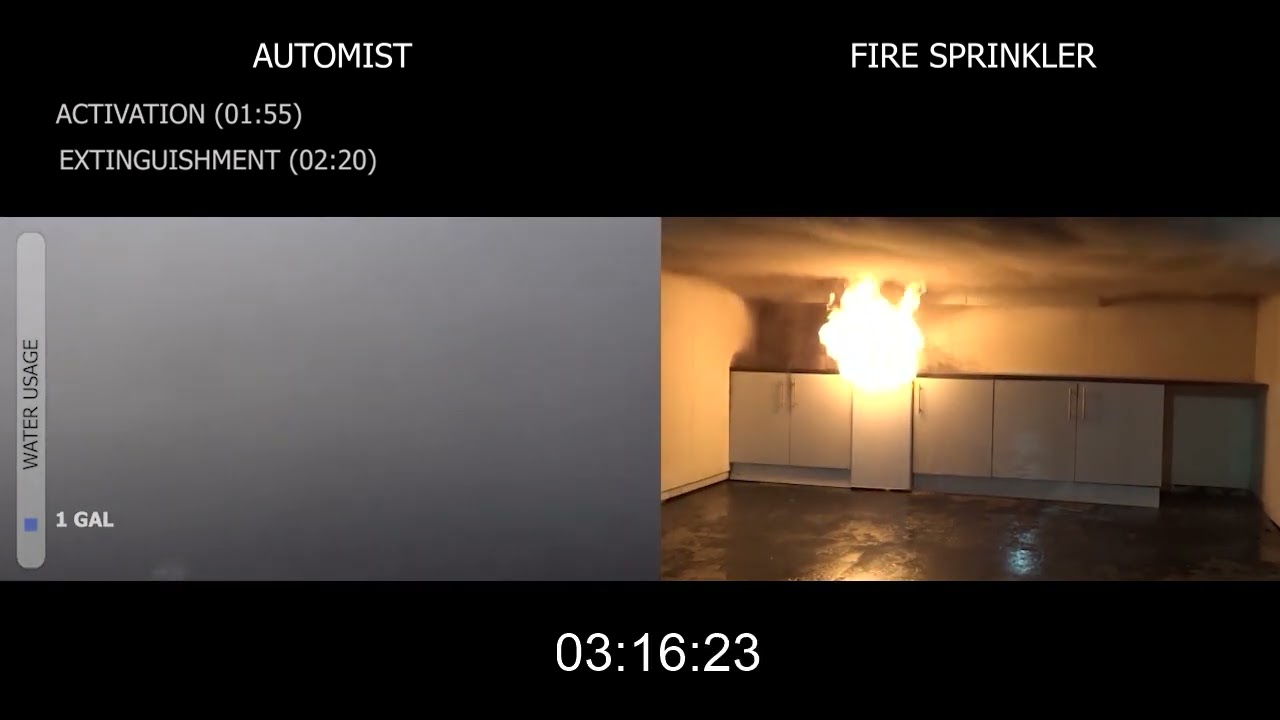

As insurers tighten underwriting criteria due to rising wildfire risk and water damage claims, automatic discounts for standard fire suppression systems are becoming less common. However, Automist stands out as an innovative loss mitigation solution — not only by reducing fire damage, but also by minimizing the risk of excessive water damage, which is a major cost concern for insurers.

In some cases, the presence of Automist has been the deciding factor in securing insurance coverage where other systems failed to meet both performance and risk management criteria.

Plumis is actively engaging with insurers to expand recognition of Automist’s benefits, and we’ve published a detailed white paper exploring this in the U.S. context: Protecting Property and Profitability – Automist for U.S. Insurers (PDF)

As more data becomes available, we anticipate broader insurer acceptance and potentially expanded incentives for homes equipped with Automist — particularly in high-risk, underinsured regions.

To find out if Automist can reduce your premium, speak to your insurer and highlight its:

- UL listing and third-party validation

- Water-efficient fire suppression

- Proven ability to limit both fire and water-related losses